Retired couple finds financial freedom

“If I’m able to pay off your existing mortgage and eliminate your required monthly principal and interest debt payments, what would you do with an additional $3,000 each month?”

A mortgage professional recently posed this question to their retired client. Sure, traditional debt consolidation can provide you with more cash flow. But $3,000? Surprisingly, this is not uncommon when a properly-trained reverse mortgage professional works with a homeowner and their trusted advisor.

The Urban Institute estimates that 38% of homeowners between the ages of 65 and 74 are paying off housing-related debt. Furthermore, over 30% of homeowners who are age 75 or older are still making a monthly mortgage payment. Sadly, most of them are unaware that the federally insured reverse mortgage product known as a Home Equity Conversion Mortgage, or HECM, is a safe and effective alternative.

Reverse mortgages, specifically HECMs, allow homeowners aged 62 and older to utilize a percentage of their home’s value to pay off existing mortgages and convert the remaining proceeds into cash or a growing line-of-credit (LOC). Keep in mind that reverse mortgages do not require a monthly payment, but the homeowner must occupy and maintain the home and pay all property charges, such as taxes and insurance.

CARL AND CATHY’S STATUS

Consider Carl and Cathy, who have no cash flow in retirement. With a quick look at their credit report, we can see the obvious reason: their combined mortgage debt, revolving debt, and installment debt require monthly payments totaling $3,000, as shown here:

If you call Dave Ramsey for help, his inappropriate solutions for retirees have been repeated for years: “Go back to work, sell your car and buy a beater, eat rice and beans today and beans and rice tomorrow, and sell the house.” Then, and only then, Carl and Cathy can implement a debt snowball strategy over the next 10 years. Will they celebrate their financial freedom at age 80? Maybe, but they may not be able to enjoy their eventual cash flow in their later years. Under a debt snowball strategy, Carl and Cathy might become debt-free, but they might find themselves back to work and renting a 1-bedroom apartment, or living with their daughter, Christine.

Sadly, non-credentialed financial pundits like Ramsey don’t bother to ask two critical questions: 1) How old are you? and 2) What is the estimated value of your home?

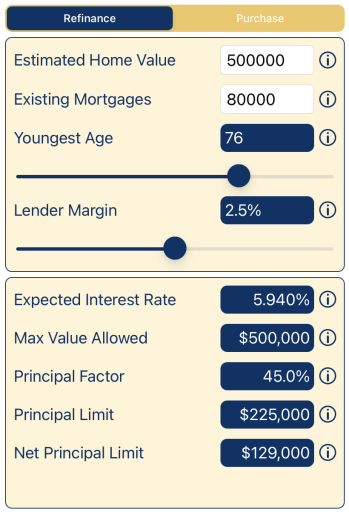

CARL AND CATHY’S HECM SOLUTION

Carl and Cathy are both age 70, with a home value over $1 million. With the help of a competent HECM specialist, Carl and Cathy can easily solve their cash flow problem in as little as 30 days.

The HECM can pay off the traditional mortgage, pay the closing costs, provide cash proceeds to eliminate consumer debt, and establish a growing line-of-credit (LOC) for future needs. And remember, there are no required monthly principal and interest mortgage payments to make, as shown here:

NOW WHAT?

Carl and Cathy eliminated $3,000 in monthly payments and paid off their revolving debt and installment debt. They even established an emergency fund (LOC). Where they go from here is up to Carl and Cathy, under the guidance of their CPA and/or financial planner. Here are common pathways homeowners take:

- Reduce draws from IRA and 401k. Stop drawing so much from retirement savings and ensure those funds last a lifetime.

- Plan for long-term care. 70% of us will need it. Nevertheless, many don’t plan for it because of a lack of cash flow.

- Optimize life insurance needs. Your financial planner and/or insurance professional will have an opinion on insurance needs.

- Complete home improvements. Don’t defer maintenance any longer. Ensure your home will allow you to age-in-place.

- Pay down the HECM. Make voluntary payments? Sure. Reduce your loan balance, increase your LOC, and create a potential tax advantage.

- Enjoy life and Travel. Live your best life now. Do you want to see family members or get away from family members? It’s your choice.

- Assist kids and grandkids. Family members may be struggling with student loan debt or finding it challenging to purchase their own home.

- Consider charitable giving. When there is no cash flow, giving can be very challenging. So, let’s create cash flow.

Of course, we don’t want to see homeowners spend their new-found cash flow irresponsibly. However, the HECM creates cash flow, liquidity, and peace of mind that should not be ignored by any financial services professional.

For more information on strategic uses of reverse mortgage and their guidelines, please consider purchasing the books Understanding Reverse, and Navigating Reverse, and subscribe to this blog.

Dan Hultquist