RapidReverse® has always offered a simple answer to a complex problem. It was designed to provide reverse mortgage professionals with 100% accurate principal limits for the federally insured Home Equity Conversion Mortgage (HECM). And RapidReverse can do that, and more, in 10 seconds or less.

However, it has relied on each user knowing current Expected Interest Rates. Remember, the Expected Interest Rate is not the borrower’s interest rate. Rather, it is the best estimate of what a loan might average over the next 10 years. HUD requires us to use that figure when calculating a borrower’s principal limit.

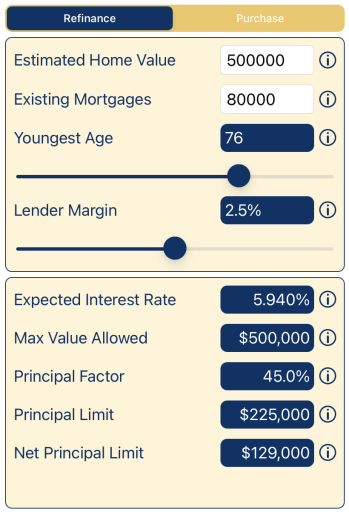

For example, if I sell a HECM ARM between Tuesday 4/18/23 and Monday 4/24/23, the average 10-year CMT from the previous week – 3.44% – would be added to the lender margins shown below:

| Margin | + 10-yr CMT | = Expected Interest Rate |

|---|---|---|

| 2.375% | + 3.44% | = 5.815% |

| 2.50% | + 3.44% | = 5.94% |

| 2.625% | + 3.44% | = 6.065% |

“But how do I know the weekly average of the 10-year CMT?”

Over the last year, this was the top request – “Let ME choose the lender margin, and YOU tell me current Expected Interest Rates in the mobile app.”

DONE! Thanks to my good friend and business partner, Tom Blankenship, RapidReverse now pulls the weekly average 10-year CMT every weekend. Your mobile application will reflect updated expected rates the next time you open it.

Update Notices:

- The slider is now labeled “Lender Margin” and will default to 2.5%.

- The “Expected Interest Rate” is now a calculated figure.

- The Tool Tips next to each term have been updated for easy explanation.

- Traditional loan origination systems may not be updated until Monday afternoons.

One additional advantage to this update: The Report now uses the current expected rate (rather than the rounded expected rate) to generate loan balance accruals and line-of-credit growth. This makes the reporting function more accurate.

We hope you enjoy this update. Please reach out to me with any questions.

Dan